Student Loan For Bad Credit Without Cosigner – The name says it all: An unsecured student loan is a student loan that doesn’t require a cosigner. A cosigner is a cosigner. If you have a private loan, the lender is responsible for maintaining your loan even if you win.

Only private student loans require an appraiser. One of the most common mistakes is requiring your parents or legal guardians to include their financial information on the Free Application for Federal Student Aid (FAFSA), which means they are receiving federal loans.

Student Loan For Bad Credit Without Cosigner

But this is not the case. Federal student loans do not require a cosigner. You can only take out a Grad PLUS loan if you have a recent bad event on your credit score. In this case, you may need to add a cosigner to the PLUS loan, which is similar to a cosigner. However, this remains a rare occurrence and does not happen to most students.

Best Private Best Private Student Loans Without Cosigner

Unsecured student loans are easier to get than regular private student loans that require an appraiser. You don’t need to include anyone’s information in the application to make the process go smoothly. Also, you don’t have to go through the awkward process of asking someone for a loan, especially if you think they won’t say yes.

Additionally, most private student loans don’t allow you to write off co-pays until you’ve been paying for several months or even a year. This can affect the cosigner’s credit score and affect their ability to qualify for a loan.

If you don’t have a lender for a private student loan, you’ll get a higher interest rate. Having a cosigner means someone else gives you money so the lender can trust that the money will be repaid. Plus, you’ll have more loan options, so you can choose a lender that offers lower monthly payments and other benefits, such as longer grace periods after graduation and higher payment options.

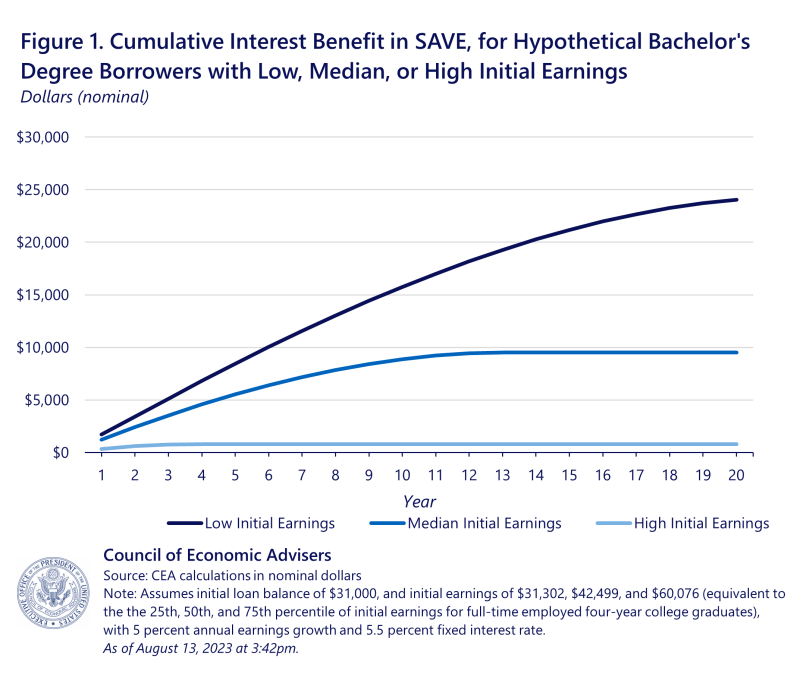

In addition, unsecured student loans have lower interest rates than conventional private loans or federal loans. If you need a large loan for your education, you may want to look elsewhere.

Best Student Loans Without A Co Signer Of 2024

U support partners are not accepted at all, while upgrading will allow you to add a carrier if you want.

With Ascent, you can choose a cash loan or a performance-based loan. A credit-based loan will look at your credit score and income, while a performance-based loan will consider your GPA and year of study.

U Grant is based on your GPA and year of school, juniors and seniors are eligible.

To apply for federal student loans, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is the primary form you must fill out to receive federal student loans and grants, work-study, and scholarships directly from the school you attend.

Fixed Rate Student Loan Refinance, Student Loan Repayments, Student Loans No Cosigner — Chicago Student Loans

You must complete the FAFSA by the school’s financial aid deadline or you will lose your federal student loan. Contact the school’s financial aid department or visit their website to find out the deadline. If you are an undergraduate student or under the age of 25, you may need to provide your parents’ financial information, including income and assets, to complete the FAFSA.

Income share contracts are marketed as an alternative to students with large federal loans or students who do not have a private student loan cosigner.

Here’s how a revenue sharing agreement works. Instead of paying a fixed amount, the lender will pay your tuition directly. Then, when you graduate and start working, you start paying a portion of your income to the lender.

Most income-sharing agreements do not require payments when the borrower is unemployed or earns less than a certain amount. This is an advantage that private loans often lack.

Student Loans With Cosigner Release February 2024

However, income-sharing agreements often cost more than traditional private student loans or federal loans. And since the amount is based on the borrower’s income, it’s difficult to know in advance how much the student will have to pay.

Since revenue sharing agreements are not technically loans, they cannot be repaid at a lower interest rate.

Juniors and seniors are more likely to be trusted. Only full-time students at a Title IV school are eligible.

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, New York, New Jersey, North Carolina , Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia and Wisconsin.

How To Get Student Loans Without A Cosigner

If you need to finance your college education and want to reduce your student loans, you should apply for grants and scholarships.

Unlike student loans, grants and scholarships do not have to be repaid after graduation. Additionally, there is no limit to the amount of money you can earn in the stock market. You can start your search by searching for scholarships directly on sites like Schoalrships.com or by doing a Google search based on your specific skills, interests, interests or background and the meaning of the word “scholarships” or “grant”.

Work-study is a form of need-based financial aid in which a student is offered a job, usually on campus, that pays a good salary. You typically work 10 to 15 hours per week and the schedule is usually flexible based on class times.

To qualify for work study, you must complete the FAFSA. Schools have a limited number of work-study spots, so you should submit your FAFSA as soon as possible to give yourself the best chance of getting a work-study job.

Getting Your Name Off A Cosigned Loan

Housing is one of the most expensive aspects of college, so why not try living for free? You can do this by becoming a Resident Advisor (RA). RAs live in the dorms and help other students by organizing events, maintaining the dorms, and more.

RAs typically receive free room and board and a free or reduced-price meal plan. Sometimes they get extra support, but it depends on the school. RA jobs are coveted, so try to apply early if you’re interested. You are here: Home / Student Loan Center / Student Loan Experts / Private Student Loans / 11 Private Student Loans Without a Cosigner

Education can be expensive, and many of us need financial assistance. In fact, student debt is on the rise in the United States.

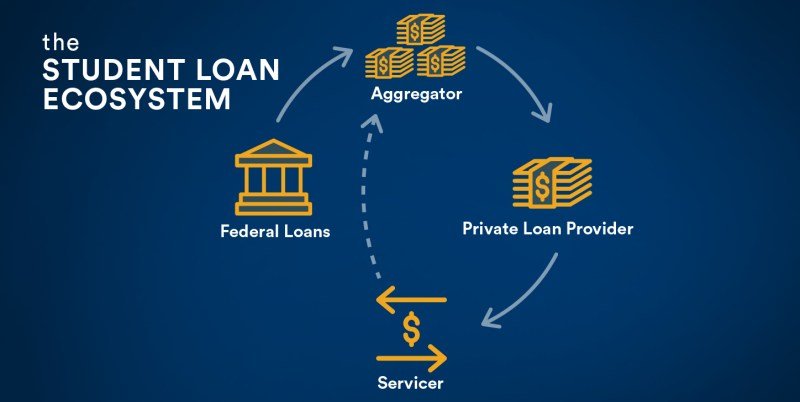

In addition to federal student aid, there are private lenders that make it easier for borrowers to get financial aid.

How To Get A Student Loan With Bad Credit

Some private student loan lenders do not require an appraiser and offer different loan repayment options.

Let’s take a look at the different options available and what it takes to qualify for a student loan without a cosigner.

A cosigner is an honorary person who shares the responsibility of taking care of the student loan and making sure it is paid in full and on time.

A cosigner is usually a parent, but other family members can also provide their credit history and income to your application, making it easier to get approved. Many students don’t have the credit history or source of income necessary to take out a large student loan.

The Best Student Loans For Bad Credit Or No Credit Of May 2022

When you share responsibility for the debt, your ability to pay on time not only affects you, but your borrower as well. Your cosigner can have a negative impact on their credit score if you miss a payment or default on the loan.

The obligor is responsible for the loan until the borrower fulfills certain conditions and requests discharge, and pays the loan in full.

Federal student loans are evaluated based on financial need and other factors. So even if you have bad credit or no credit history, you can get approved without a cosigner. However, private student loans often require a cosigner if you don’t qualify to be co-approved on your own.

It’s best to consider federal student loan options before turning to private student loans to supplement your education needs.

The Answer Sheet: Student Loans

Because degrees are difficult for most students to obtain, 96% of private student loans are consolidated.

To qualify for credit-based loans from other lenders, students need at least two years of credit history, earn at least $24,000 a year and have a low debt-to-income ratio. Students with no credit score or eligible students who meet the minimum credit score but do not have a two-year credit history can apply for some unsecured loans.

$24,000 is the minimum salary required to qualify for an unsecured loan; Most lenders require an income of $30,000 and above.

Asking a family member or friend to co-sign for you has advantages:

Best International Student Loans For African Students 2024

It has “zero fees” which means no loan application fee, origination fee or upfront fee. This is

Student loan bad credit no cosigner, personal student loan without cosigner, private student loan with bad credit no cosigner, find cosigner for student loan, international student loan without cosigner, student loan no cosigner, student loan bad credit cosigner, student loans without cosigner bad credit, student loan without cosigner and bad credit, student loan without cosigner bad credit, student loan without cosigner, student loan options without cosigner