“crypto In The Hong Kong Spotlight: Unraveling The Secrets Of Success” – Share on Twitter Share on linkedin Share on facebook Share on telegram Share on whatsapp Share online

Digital currency groups attract attention due to suspicious fund transfers Top blockchain and virtual currency news: DCG under investigation; Lido DAO surges as Shanghai Ethereum upgrade arrives Hong Kong is burning cryptocurrency credentials.

“crypto In The Hong Kong Spotlight: Unraveling The Secrets Of Success”

It is often said that there are three good things. Trends in the cryptocurrency industry over the past few days show that the opposite is still true.

Bsc Project Spotlight: Zoo Crypto World

The bleak picture surrounding the cryptocurrency empire led by Barry Silbert Digital Currency Group (DCG) may not have reached the level of fear seen by FTX or Terra, at least at the time of writing. However, the news that US federal prosecutors are investigating money transfers between DCG and one of its subsidiaries may be the third wave of restructuring nausea that has shaken the crypto industry in recent days.

If there is a silver lining in the possibility of another major crypto crash, it is that authorities have been paying close attention to possible problems with DCG for at least two months, most importantly even before the FTX event. If such a filing is necessary, we can only hope that justice is served quickly and crypto investors are spared further suffering.

At the same time, evidence continues to emerge of the resilience of the digital asset industry, despite new challenges and this time a long-awaited upgrade to Ethereum. The Shanghai hard fork, as it is known, promises to solve the concern among investors who hold shares in ETH that they will be able to withdraw their assets, and this has led to increased interest in goods and services, and increased. At the price of some tokens. .

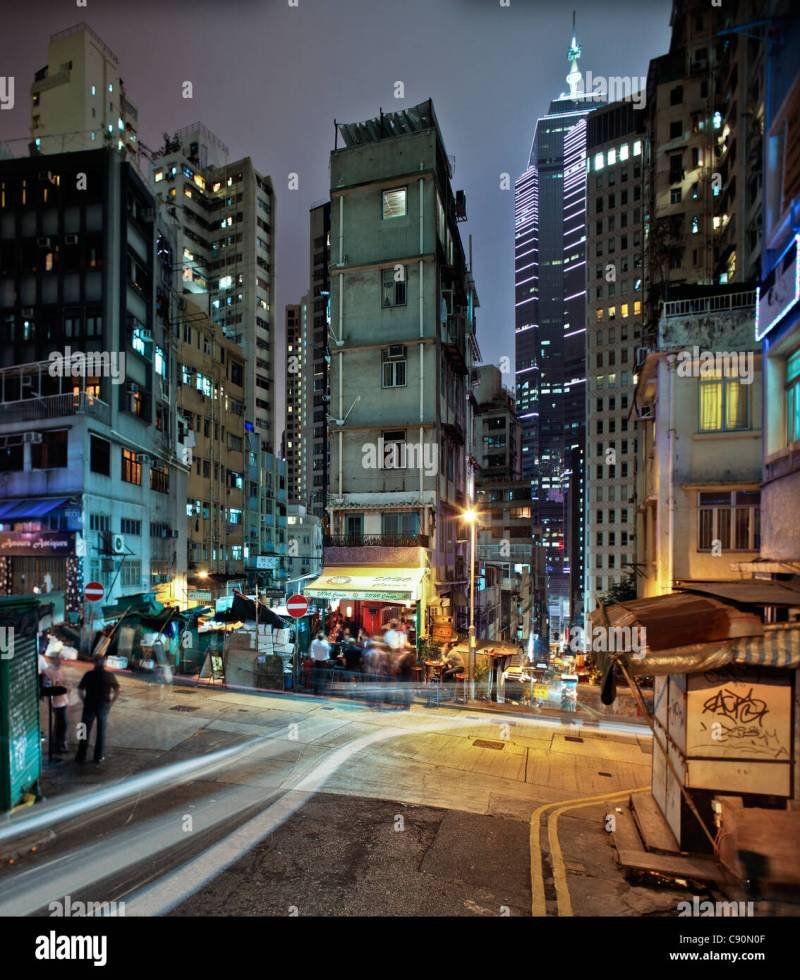

And in good news for the city in need of time, the financial authorities of Hong Kong have expressed their intention to restore the points lost to other jurisdictions, especially Singapore, in the ranking of crypto hubs. Hong Kong has a long history of picking winners, and not betting on digital assets, despite the hardships it has caused Hong Kong and its people in recent years.

Ripple’s Win Elevates Xrp With Hong Kong’s Top Crypto Index Inclusion

The digital currency group has been on the radar of US authorities since the collapse of cryptocurrencies fund Three Arrows Capital last year. Image: DCG/Canva website

Digital Currency Group (DCG), a group of companies specializing in cryptocurrencies, has been arrested in connection with suspicious transactions between DCG and its subsidiaries, according to a Bloomberg report citing anonymous sources. It is said to be under investigation by the US Department of Justice and the Securities and Exchange Commission (SEC).

Cryptocurrency infection is still growing. While much of the focus of the DCG saga has been a very public feud between two companies that are friendly to Wall Street, the crypto industry and their leaders, one important development is that the authorities quickly intervened.

According to Bloomberg, US authorities have been investigating DCG’s practices since before the collapse of FTX. And while there are no official accusations of wrongdoing (yet), it is good to know that regulators are becoming more active in the crypto industry, arresting participants who violate the law is a good thing.

Hk Gives Spot Bitcoin And Ether Etfs Green Light

But perhaps the biggest takeaway from this story is how one of the ideals of cryptocurrencies seems to be shaky. The phrase “WAGMI”, or “we all succeed”, has been chanted among digital currency believers for years. This also became the slogan of a group of crypto enthusiasts who bought the English football club Crawley Town.

Recently, the collapse of FTX has caused several companies in this space to fight for dominance and survival. For example, Binance’s decision to call FTX and withdraw assets held in FTX, a company it previously supported, played a major role in the collapse of the current exchange.

The Lido DAO (LDO) account staked protocol has surged more than 50% in the past week ahead of an Ethereum upgrade that is expected to allow Ether stakers to withdraw assets and address other ETH-related risks. The upgrade, called the Shanghai Hard Fork, is scheduled to take place in March.

While centralized exchanges and companies seem to be on the decline, DeFi is on the rise again.

Hong Kong Courts Crypto Industry As Other Governments Crack Down

The total value locked in the DeFi protocol has been on a downward trend since peaking at the end of last year, according to the latest data. Although this increase is small and only part of the prosperity of the DeFi market in November 2021, it is a sign of growth in a market that is still in its crypto winter.

However, DeFi is still far from replacing the role of centralized exchanges as the main channel for new cryptocurrency users to enter the space. The user experience is complex, and the lack of a central authority to vet new tokens is a breeding ground for dodgy businesses.

Uniswap, one of the largest decentralized exchanges, is a hot spot of fraud, almost 98% of all tokens listed on the platform are fraudulent to deceive investors, according to a new study.

A centralized company with good management is bad, but a decentralized company without control or accountability. Developers and supporters of DeFi should see the crisis of trust that engulfs the cryptocurrency business as an opportunity to prove that it is a viable alternative.

Bittensor Sparks Interest But Pushd Presale Steals The Spotlight

Hong Kong’s plan for the development of the cryptocurrency industry is very different from the way China is trying to eliminate it. Image: Canva

Despite the collapse of the new famous cryptocurrency exchange, Hong Kong is continuing to develop its Web3 industry as part of a plan to restore itself as a global cryptocurrency center, Paul Chan, Hong Kong’s financial secretary said at a conference in Hong Kong. District this week.

A speech by Hong Kong’s finance minister this week underscored the city’s ambitions to take a different path than mainland China for the digital asset industry. Unlike China, which will ban crypto trading in 2021, Hong Kong is set to welcome a new licensing regime that could open up the market to retail crypto trading. Under current regulations in Hong Kong, a semi-autonomous special administrative region from China, only institutional and professional investors with assets of approximately US$1 million or more are allowed to trade in digital assets.

China just opened its border with Hong Kong last Sunday. In the new recruitment plan that was released 2 weeks ago, the Hong Kong government has now received jobs. More than 200 jobs a day, expected to replace around 140,000 workers, mostly skilled workers The event was approved. According to the report of the Straits Times of Singapore, these people have left the area in the past two years.

Binance Edges Closer To Making Bid For Hong Kong Crypto License

The new talent plan is expected to support the growth of Hong Kong’s Web3 industry. Adrian Wang, CEO of Metalfa, a Hong Kong-based digital asset management platform, said:

The city’s existing talent pool in the financial industry also has the potential to bring innovation and new ideas to expand the long-term success of the crypto industry.

However, one issue that regulators will have to address is whether mainland Chinese will be allowed to legally work for crypto companies in Hong Kong. Under China’s strict 2021 crypto ban, Chinese people working for crypto trading companies in other countries can violate Chinese laws, but how does it affect crypto workers and investors in Hong Kong?

To attract top talent, the authorities need to set clear rules for crypto-related jobs in Hong Kong and avoid forcing Chinese nationals to work in legal gray areas, especially since the Hong Kong authorities have experienced an exodus. The young population has increased over the past few years, making it an attractive place to live and work.

Crypto News Roundup: 25th — 31st Jan 2024

Is a digital media platform that presents emerging technology stories at the intersection of business, economics and politics. From Asia to the world.

An unforgettable weekly roundup of the hottest tech news from an Asian perspective, featuring commentary from Editor-in-Chief Angie Lau. Please check the latest version.

Indian crypto companies are entering Dubai to escape high local taxes and seek comfort in the emirate’s regulatory environment. As the cryptocurrency industry continues to develop around the world, Hong Kong is now in the spotlight due to innovative measures by regulators. . Hong Kong’s Financial Services Authority (SFC) has given the green light to launch Bitcoin and Ethereum-based exchange trading funds (ETFs) in the spot market, making Hong Kong the first region to do so.

Hong Kong has made history in the crypto industry by becoming the first region to pass the approval criteria for issuing Bitcoin and Ethereum-based exchange-traded funds (ETFs) in the spot market.

Hong Kong Bans Two More Crypto Sites For Misleading Investors

This is a big step for Hong Kong, as China will ban all crypto transactions in September 2021. The deal has fueled investor enthusiasm, especially given the large influx of Chinese investors into foreign stocks due to the strong economy.

The langham hong kong, the mercer hong kong, the jervois hong kong, the secrets of success, the putman hong kong, the penisula hong kong, the pottinger hong kong, the mahjong hong kong, the murray hong kong, the rosewood hong kong, the cityview hong kong, sweet secrets hong kong