“emerging Trends In European Travel Insurance: New Benefits For Modern Explorers” – All new things Start Scouting Scouting trends no. 1 Observation Platform Corporate innovation initiatives Lessons from initial challenges Unlocking the innovation trap Innovation stagnation.

Want to know which insurance technology trends and initiatives will have an immediate impact on your business? Explore in-depth industry research on 1,412 global startups and start-ups and gain insight into how technology is being used in the Insurance Technology Innovation Map!

“emerging Trends In European Travel Insurance: New Benefits For Modern Explorers”

Industries are increasingly embracing digitalization, and insurance technology is no exception. New insurance technology solutions such as artificial intelligence (AI), Internet of Things (IoT) and cloud computing are replacing legacy systems and improving operations. These technologies provide reliable data insurance services. Some of these include automated solutions for claim processing and fraud detection. Finally, the industry also uses technology to improve the customer experience.

European Countries Occupy 19 Of World Sustainable Travel Index 2023’s Top 20 Spots

To perform this in-depth analysis of the top insurance tech startups and startups, we surveyed a global sample of 1,412 startups and startups. The result of this research is data-driven innovation that improves strategic decision-making by providing an overview of new technologies and startups in the insurance technology industry. This information comes from our work with our big data and AI-powered StartUs Insights platform, which covers more than 2,500,000 startups and startups worldwide. The world’s largest source of information on startups, the SaaS platform provides fast and comprehensive discovery of relevant startups, new technologies and future industry trends.

In the innovation map below, you’ll find an overview of the top 8 insurance technology trends and innovations affecting more than 1,400 companies worldwide. In addition, the Insurance Technology Innovation Map reveals 16 carefully selected initiatives, all working on emerging technologies that advance their respective fields.

According to the Insurance Technology Innovation Map, the following treemap illustrates the impact of 8 major insurance technology trends: Artificial intelligence streamlines slow, manual processes in the insurance industry and reduces the potential for error. Currently, the use of blockchain and the focus on cybersecurity are introducing new security measures, increasing the focus on transparency and increasing customer confidence in the industry. Innovative technologies create opportunities for remote collaboration and enhanced marketing. Other trends, such as the development of insurance products and bundled insurance, are leading to the adoption of more comprehensive insurance services.

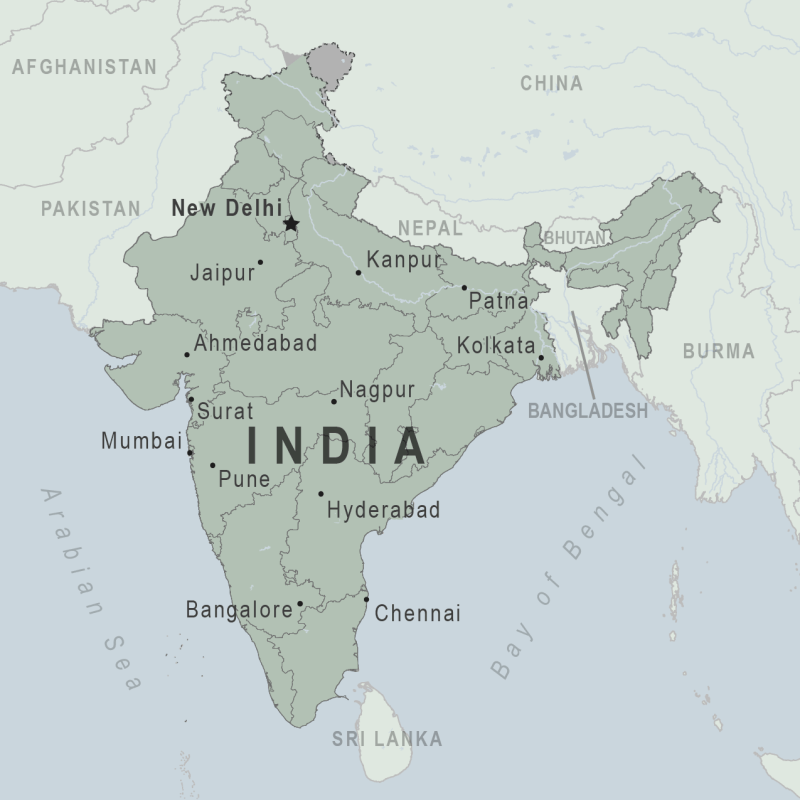

The global enterprise heatmap below provides insight into the global distribution and metrics of the 1,412 sample companies we analyzed for this study. The heatmap created using the StartUs Insights Discovery Platform shows that Europe and the US are the most active startups.

Singapore Tourism Statistics 2023

Check out these 1,412 great startups and 16 of the startups and the solutions they’ve developed below. These insurance tech startups are selected based on criteria such as year of founding, location, fundraising, and more. Depending on your specific needs, your best choices can vary greatly.

The insurance technology industry has been experiencing rapid adoption of artificial intelligence and related technologies in recent years. Startups develop AI-based solutions to reduce labor-intensive operations and errors. These services range from insurance claims management to risk estimation. In addition, the insurance industry also produces large amounts. Many expansion companies and startups are using artificial intelligence to turn this data into things that will make InsurTech operations more efficient.

US-based EvolutionIQ is building a predictive demand management platform. It improves claims management, assists the professional team, and detects fraud. By using unique and temporary personal data, it allows insurance analysis teams to improve their ability to process claims and shorten claim times. It helps insurance companies to improve their performance and thus increases customer satisfaction.

Bubble Insurance is a US-based startup offering a unique digital insurance service. Consumers combine life insurance with homeowners insurance when they buy a home or refinance their mortgage. This allows homeowners and buyers to protect their families from the unexpected. Using artificial intelligence, it finds the right coverage for home insurance and related plans to suit each client’s needs.

Chinese Tourists Are Traveling Again, Opt For Domestic, Remote Travel

The main reasons behind the spread of blockchain technology are security and transparency. For the insurance industry, this reduces the administrative costs of managing insurance claims and securing payment. Blockchain also allows for fast data exchange and also provides protection against fraud. Also, cryptographic protection methods make blockchain highly reliable in terms of storing and transmitting insurance information.

Hong Kong-based startup YAS offers optional microinsurance. It offers a wide range of insurance services for various end users such as pedestrians, cyclists, runners and drivers. These are all low-cost insurance options to protect drivers. All sensitive customer data collected for insurance purposes is protected using the blockchain architecture on which YAS is built, giving customers greater confidence that they and their data are safe on the platform.

Luxembourg-based startup Ibis is developing a global risk-sharing platform for agricultural insurance. The startup’s platform offers an affordable and automated microinsurance environment using real-time and blockchain technology. This allows farmers and growers to benefit from the future insurance policy and increase the stability of the crop. This helps reduce poverty and improve food security.

Package insurance combines insurance with a product or service transaction at the point of sale. These packages are either hard packages with extras such as a warranty or soft packages where the customer has a small increase but can opt out. This is an emerging development in the insurance industry as it increases the availability and accessibility of insurance services. As a result, insurance companies are using this technology to increase their penetration in different markets and customer demographics.

Southeast Asian Travelers Are Back

UK startup WeCovr is developing an insurance API. These APIs support mobile and web applications and allow online merchants to integrate insurance into their product sales. This provides online stores with additional sources of income while making their purchases safe for end users.

US-based startup Lisa Insurtech is a developer of insurance gateway technology. Lisa’s Gateway is a technology that solves the challenges of collaboration between insurers, brokers and startups. The gateway acts as a facilitator, enabling insurance products to be integrated with a variety of services and products, such as business intelligence software, payment gateways, and more. Lisa Insurtech is developing insurance as an ecosystem of services with her entry.

Internet of Things (IoT) technologies are driving digital transformation in the insurance industry. In today’s fast-paced business environment, customers expect instant results. That’s why companies in various industries, including the insurance industry, are trying to improve customer experience and loyalty with digital tools. IoT devices enable the continuous collection and exchange of data between networks, thereby accelerating and improving the request process, reducing data duplication and reducing customer dissatisfaction. Customers no longer need to waste time on paper, they now collect valuable information directly from their devices and efficiently process insurance claims.

.svg?strip=all)

My Startup Risk Panel provides IoT business risk management. The startup offers a cloud-based My Risk io platform that integrates with connected devices in an industrial environment to assess risk and make informed decisions. It also has cloud computing and integrates with existing systems. The platform provides continuous monitoring of industrial assets and helps prevent risks to improve the accuracy of insurance commitments.

Tech In 2023: Here’s What Is Going To Really Matter

American startup Labs is the developer of a weather forecasting platform used to provide accurate data for the agricultural industry. The startup’s platform provides machine learning-based predictions for specific locations using publicly available data and real-time data from IoT sensors. The main purpose of the platform is to reduce the differences between environmental information available to insurance companies and customers. It also helps insurers develop cost-effective insurance models using real-time data.

As the growth rate of cyber attacks increases, cyber security is becoming an important trend in the insurance industry. Many legacy insurance providers do not have the knowledge and tools needed to prevent these attacks or losses. Startups fill this gap by providing online solutions that protect the interests of insurance companies and consumers. These solutions prevent various types of fraud on the internet and protect sensitive user data.

Israeli startup Nsure.ai has created a fraud detection platform. The platform uses artificial intelligence to distinguish real buyers and sellers from scammers. The platform has real-time anomaly detection to protect transactions. In this way, Nsure.ai enables sellers to trust and sell risky digital products.

Singaporean startup Protos Labs takes a threat-based approach to cyber risk management for insurers. The startup’s risk assessment platform reports cyberattack analysis that shows which threats insurance companies are most exposed to. It uses predictive machine learning to non-invasively assess its customers’ tolerance. Protos Labs’ approach to cyber insurance allows insurers to assess exposures and accurately measure risk.

Europe Travel Insurance Requirements

There is a significant technology adoption gap in the insurance industry worldwide and there is a significant domestic application of legacy technologies. Replacing all major systems as cloud technology evolves helps insurers quickly introduce new products and improve customer service. The cloud is also essential to provide the computing power needed to understand and use it.

Emerging trends in banking, emerging trends in marketing, emerging trends in it, emerging trends in business, emerging trends in hr, emerging trends in retailing, emerging trends in insurance, emerging trends in healthcare, emerging trends in education, emerging trends in technology, trends in emerging markets, emerging trends in ecommerce