How Much Mortgage Can I Afford Based On Income Calculator – The old rule of thumb from the 1980s is that you need to save 20% for a down payment to buy a home! In today’s housing market, there are many affordable loan programs that allow you to buy a home with a 3% down payment. Closing costs are usually another 2% or 3% of the purchase price. Closing costs typically include appraisal fees, title insurance, and other costs associated with buying a home. This means you should make arrangements for up to 6% of the purchase price for down payment and closing costs.

One strategy that some buyers are considering in today’s market is to negotiate with the seller to pay the closing costs. This may be more beneficial to you than asking for a lower purchase price. Contact me to learn more about what prepayment options and negotiation strategies may be available in your situation.

How Much Mortgage Can I Afford Based On Income Calculator

In today’s market, you can generally expect your monthly housing payment (mortgage, property taxes, home insurance and housemate fees) to be no more than 30% of your monthly income before taxes. Total monthly payments on all debts, including car payments, credit cards, etc., should generally not exceed 45% of your monthly pre-tax income. Of course, these are just general guidelines, and you should talk to a mortgage professional to determine the numbers for your specific situation.

How Much House Can You Afford?

Monthly payments are higher today than recently due to rising housing prices and interest rates. Remember the rent goes up too. With a mortgage, you can at least lock in your interest rate to prevent your monthly payment from going up in the future.

NEO Home Loans – Luminate Home Loans, Inc. NMLS Company Unit #150953 | Equal housing lender. Corporate headquarters at 2523 S. Wayzato Blvd. Suite 200, Minneapolis, MN 55405. This notice is not a credit report or a credit commitment. Approval of loans and/or loan commitments are subject to final review and approval by the underwriters. This information describes the minimum down payment requirements allowed under the specific loan program and product guidelines. The loan plan and repayment terms are based on a 30-year fixed term for conventional loans only. Interest and APR and any/and all loans offered will be subject to individual applicant pricing and underwriting. According to the Central Bank of St. Louis median home sales price in the United States is $436,800. But still, even if you make $120,000 a year and have a $15,000 down payment, your home’s affordability could be anywhere from $265,000 to $400,000 (depending on a few factors specific to your situation). Increased affordability depends not only on your income or down payment amount, but also on your exact location, current debt, market rates, financial goals and more. it depends on many things. If you want to get straight to the point, try our comprehensive home buying service, which automatically assesses your situation and gives you clear, personalized advice to improve your home buying experience. You can also try our free house price calculator. If you want to learn about home accessibility, keep reading.

Let’s look at some examples. For these two examples, let’s say our potential home buyer has a $120,000 annual salary, $15,000 in available savings, good credit (700-739), and current obligations (car payments, student loans, credit cards). payments) $1,500 per month.

First time home buyer in Austin, Texas. Another is buying a house in Boston.

How Much A $200,000 Mortgage Will Cost You

Remember these numbers are just guesses and how much house you can get for 120k depends on many variables besides the amount of money you have each month – monthly loan payments are an important factor and the other is the amount of money you have. have saved Making your home affordable requires the knowledge and tools you need, and we’re here to help. Our calculators will do the hard work for you.

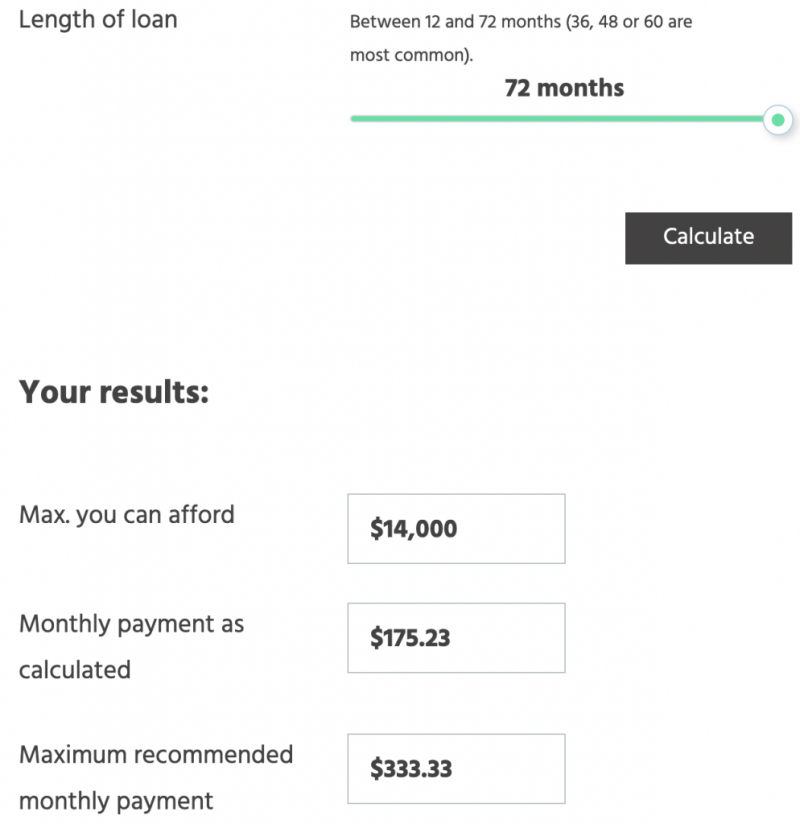

Let’s dive into the inner workings of the How Much Home Can I Afford Calculator to see how it can help you more efficiently navigate the home buying process.

Debt-to-Income Ratio (DTI): Your DTI is an important factor in determining which mortgage is right for you. This ratio is calculated by dividing monthly debt payments by monthly gross income. Depending on your credit score, DTI can be as high as 50%, and many lenders are willing to accept higher rates if you have a stable income and good credit. So if you make $120,000 (about $10,000) a year. per month), you want your future mortgage, including total monthly payments, to be less than $3,600.

Down payment: The size of your down payment has a significant impact on your chances of owning a home. If you qualify for a certain mortgage, having more cash available will allow you to purchase a more expensive home. A larger down payment for the same home price leads to lower mortgage payments which in turn leads to lower monthly payments. This change has a big impact on your borrowing capacity and debt-to-income (DTI) ratio.

How Much Mortgage Can You Afford? Here Are 5 Different Ways To Figure It Out

Credit score: A higher credit score unlocks lower interest rates, which means lower monthly payments and more of your money growing (compensating lenders for lending you money). For example, on a 30-year, $240,000 mortgage, lowering your interest rate from 4 percent to 3 percent could save you about $50,000 over the life of the loan.

Interest Rates: When it comes to interest rates, current market rates can have a significant impact on the total cost of your loan. The interest component can add up to tens of thousands of dollars over the life of the loan, affecting the type and value of your home.

Loan Term: A shorter loan term (such as 15 years) will result in higher monthly payments but lower interest rates over the life of the loan. Conversely, a long-term loan (such as 30 years) will have lower monthly payments but higher interest rates over time. Your choice depends on your financial comfort with monthly payments. Remember that just because you qualify for a certain amount doesn’t mean you have to borrow that much. Always consider other life goals, emergency funds, and lifestyle choices. It’s all about balance.

When buying a new home, you may have asked yourself one of the following questions: What is the best way to maximize your finances? How do I know if I’ve overpaid on my mortgage? Where can I find the lowest interest rates for new mortgages and optimize my mortgage choices? How can I lower my debt-to-equity ratio? If you have questions like these running through your mind, you may feel that you need personal financial advice.

How Much House Can I Afford? Pro Tips And Home Affordability Calculator

Today’s financial world is full of resources, but it’s hard to separate the scams from the legitimate financial guides that will help you effectively manage your debt and maximize your finances. If you are looking for a personal answer to the question “how much house can I buy on 120k salary” you are in the right place. We offer objective financial advice that works, including free tools to get you started and affordable, personalized advice tailored to your needs. Use our free home affordability calculator to explore different scenarios and get personalized debt advice using the latest financial advisor technology tools like debt optimization to maximize your ability to buy a home or the best strategies for your financial goals.

Previous Read How Much House Can I Buy With 100k Salary Read Next How Much House Can I Afford With 80k Salary? We’re here to help you navigate the exciting world of home buying, especially when it comes to asking, “How much can I afford?” we will answer the question.

Our home price calculator is like your personal compass, guiding you to your dream home without breaking the bank.

So, are you thinking about buying a home? Great selection! But wait a minute – before you dive in, it’s time to solve the magic question:

How Much Should You Put Down On A House? Not 20%

Introducing our trusted partner: the mortgage calculator. It’s like a crystal ball that allows you to see into your future home ownership.

Our calculator is your budget’s best friend. It gives an estimated purchase price based on your perfect monthly payment. And what do you think? It can even redesign things – put in a certain price and it will show you the monthly fee that comes with it. But here’s the thing: A calculator doesn’t have all the secrets that mortgage experts do. It’s a healthy start, but not the whole enchilada.

Let’s dive deeper – ready for the inside scoop? Our How Much Home Can I Get? is your golden ticket:

Along the way, we’ve got 7 handy tools and supplies to help you make your furniture dreams come true. From buying the home you want to saving and paying your monthly budget

Two Person Mortgage Qualification Calculator

How much mortgage can i afford based on rent, how much house can i afford calculator based on income, how much house can i afford based on income, how much mortgage can you afford based on income, how much can i afford based on income, how much mortgage can i afford based on income, how much mortgage can i afford based on monthly payment, mortgage calculator based on income, how much loan can i afford based on income, how much mortgage can i afford based on income calculator, mortgage calculator how much can i afford, how much can we afford mortgage calculator