How To Calculate How Much You Can Afford For Mortgage – If you want to buy a house, the first thing you need to know is how much your mortgage income will last. Find out how much you can borrow from this article.

Finding the right home for you and your family can be difficult, but it’s important to know how much you can afford before you start your search. – license plate.

How To Calculate How Much You Can Afford For Mortgage

When you’re looking to buy a home, whether it’s your first or last, you need to consider several factors, the most important of which is how much you can afford.

Afford This Home

The right mortgage rate to ask depends on many factors, so today we want to give you some tips to know how to calculate the best mortgage loan for you. Read on for more information.

Buying a new home is exciting, but it doesn’t have to make you anxious and nervous. It should give you a sense of peace and financial security. The last thing you want is to fall in love with a home only to find out later that you don’t qualify for the loan.

Therefore, good credit should be based on the 28/36 rule which states that mortgage payments (including property taxes and homeowner’s insurance) should not exceed 28% of your income.

In this equation, 36 represents your monthly debt, which should not exceed 36% of your income. Both of these rates are calculated on pre-tax dollars.

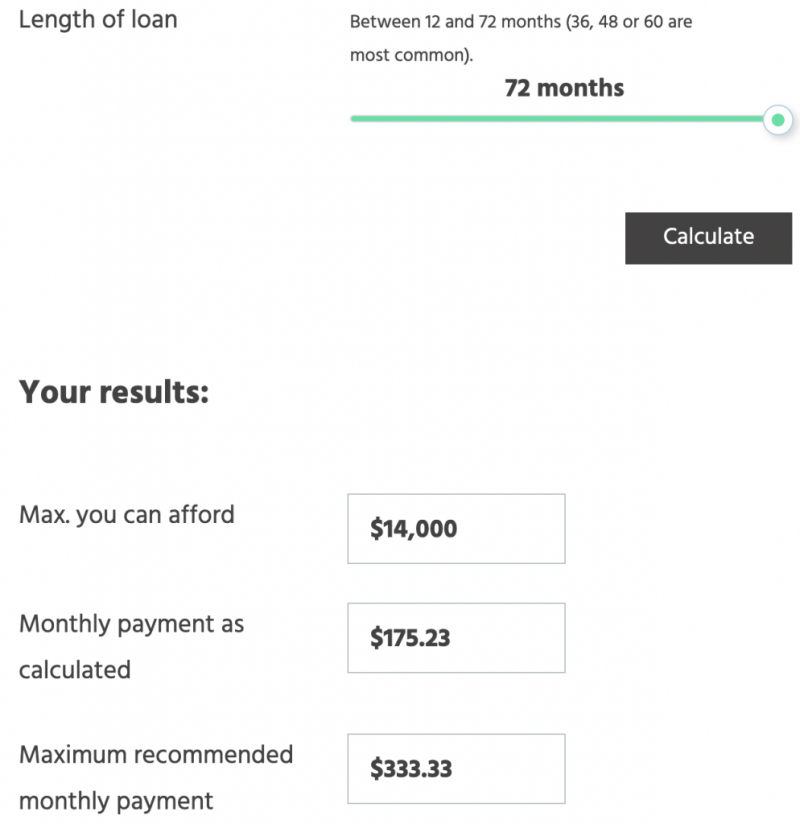

How Much Car Can I Afford? [free Calculator]

Most lenders work with this rule, although in some cases you can get a loan of 40% to 43% of your income, but in these cases it is a large premium and it is difficult for you to pay.

But the best decision for your overall budget is to keep your debt below 28% of your monthly income so you can breathe and not worry about your debt.

Staying within the 36% limit allows you to manage all your debts while maintaining a comfortable lifestyle.

These rates are reasonable, whether the down payment is 3.5% or 20%, and are the most common methods used in calculating the mortgage on a typical home loan.

How Much Car Can You Afford?

USDA loans are low interest loans with $0 down, low interest, no bad credit, and want to live with the option.

But if you’re like the 76% (4) who want a solid or stable loan to buy one of the 701,000 (5) homes sold in 2019, you can be sure that it’s free of charge- For your salary, The 28/36 method is the best way to guarantee yourself a comfortable loan, a regular and stress-free life.

Therefore, the best mortgage amount is the one you can pay each month, while allowing you to be responsible for your other obligations and an income to live on, if possible.

You know that you don’t want to live every day, every month to cover all your obligations such as utilities, groceries, loans and debts, and most importantly, the mortgage.

Ask Yourself

Fewer than you want to be part of the number, such as 624, 753 borrowers (1) who have not paid their loan and are now in trouble.

This is the pre-tax amount owed on your home. It can come from you, your spouse, and/or your co-signer; and any additional pre-tax income you receive.

You should have an amount of money that you report as income each month, so you know you can always count the money you have.

A down payment is the first amount of money you expect to pay the lender in advance to purchase the home.

How Much House Can I Afford?

This amount can be as high as you can afford, most lenders want a 20% down payment, but in some cases, it can be as low as 3.5% of the total value of the property.

While the average down payment is 12% of the home’s value (2), the higher your down payment, the lower your monthly mortgage payment.

Every month, in addition to the mortgage, you have to pay other expenses: maybe a student loan, your property, the rent of your current house, etc.

Make sure you make a list of your regular expenses, add an extra 10% for unexpected events and save that amount.

Critical Considerations When Deciding How Much House You Can Afford

This is the largest monthly payment you will make on your loan. To calculate, you must follow the formula:

In this example, the maximum monthly mortgage payment calculated on the first rate is $1,120.

This is the maximum monthly payment you will pay on your mortgage, calculated using your credit score.

When you visit a personal loan office, the professional evaluator will use the following two numbers to calculate your credit, for example, it is $1,040, which is very close to the average loan of 1,100 people who pay an average rate of 6%. below .hanging (6).

Julie Ann Soriero

This amount is used to calculate the maximum home value you can afford.

Every situation is different for everyone. We encourage you to call our office today so we can get you an accurate estimate of your unique situation.

When you’re looking for your perfect home, you’ll want to maximize your mortgage needs. Once you know your approved loan amount, follow these tips:

This is not after the sale, but can go up when you find the house you want to buy.

Income Vs. Mortgage: How Much House Can You Afford?

Always try to pay as much as you can. This way your monthly payments, taxes and other fees will be lower, making your home more affordable.

Make sure you get 10% of your home’s value as down payment. If you put down a 20% down payment you won’t pay private mortgage insurance (PMI).

But if you can’t get close to 10%, make sure you save as much as you can for the fee.

When you pay off your loan, you should have a small amount to help you in an unexpected event.

How To Determine Your Home Affordability

Maybe you need to renovate a new house, or cover some medical bills, or do some car repairs. You want to make sure you have enough cash to cover these charges without breaking the bank.

The recommended amount of money to keep in a savings account is 3 months of your regular expenses. But ideally, you should have your monthly loan for 6 months.

Keeping these funds after your purchase is a good way to help ensure you don’t have to worry about closing. Plus, it’s the amount of savings you’ll need to make future mortgage payments if your financial situation changes.

There is nothing wrong with looking on the Internet, but it is better to work with a professional for you and your interests because they have current market trends, listings that are on the market, and links that can lead to you. The assistants are very familiar. find a better place. your money at home. We have close relationships with many real estate companies that we are happy to recommend.

How Much House Can I Afford? 5 Factors To Consider Story

In most cases, using a vendor is free, so it doesn’t mean you have to pay.

Congratulations! You’ve been approved and you’ve reached your goal of becoming a homeowner. However, the journey began.

You must remember that when you take out a mortgage loan, you must make sure that you meet your monthly payments because if you don’t there will be negative consequences.

The main effect is, of course, deterioration (7). This means that you won’t be able to keep up with the various payments and presumably you won’t be able to cover the loan. Therefore, your house is closed.

How To Determine How Much House You Can Afford (with Pictures)

Another negative consequence of not paying your loan on time is that you may incur additional charges, and additional interest charges for non-payment. This will cause you to pay before you start, so it becomes a vicious circle that will hurt your position.

As a result, your credit score will suffer. Your result will be low, and mortgage or other situations will be difficult. You will no longer be seen as a responsible person.

Therefore, we encourage you to follow the advice given in this article. That way you can enjoy your new home purchase for many years to come.

As you can see, the home buying process involves many steps. Finding a mortgage that fits your budget and lifestyle will help you really enjoy your new home because you don’t have to.

Calculate How Much Car You Can Afford Per Month

How do they calculate how much mortgage you can afford, formula to calculate how much mortgage i can afford, how to calculate the amount of mortgage you can afford, calculate how much mortgage you can afford, how to calculate if you can afford a mortgage, how to calculate how much house mortgage can i afford, how to calculate how much i can afford for mortgage, calculate mortgage you can afford, how to calculate mortgage i can afford, how to calculate how much you can afford for mortgage, how to calculate what you can afford for a mortgage, how to calculate how much mortgage can afford